Currently, short of death, it is nearly impossible to have your student debt forgiven—even during bankruptcy. However, the 20-year-old rule that forbids most people from using bankruptcy to wipe clean their student loan debt is under scrutiny after a Wall Street Journal report showed that some judges are more open to helping debtors with crushing student loans.

While this doesn’t create an avenue for everyone drowning in student loan debt, it does give a glimmer of hope to those struggling to repay student loan debts because of low wages and other economic hardships.

How Are Bankruptcy Judges Trying to Help Student Loan Debtors?

Judges are trying to help student loan debtors in a variety of ways. For example, some judges are suggesting potentially eliminating tax bill that links to student loan debt relief or debt cancellations after 25 years through federal repayment programs. Another example includes allowing student loan borrowers to make full payments during the Chapter 13 debt repayment period. Further, judges across all political leanings want private student loan debt from unaccredited schools canceled.

There is a generation of young adults who are struggling to get their head above water. Student loan borrowers in the United States collectively owe almost $1.5 trillion in student debt. According to the Brookings Institute, nearly 40 percent of borrowers will default on their student loans by 2023. Average students in the class of 2015 have $37,172 in student loan debts. Because borrowers are struggling to repay student loan debts because of low wages and other economic hardships, bankruptcy is often one option that gets floated.

Bird’s Eye View: Student Loans and Bankruptcy

Student loans are now the second highest consumer debt category—behind mortgages. However, unlike credit debt or mortgage debt, students loans traditionally cannot be dismissed by bankruptcy.

Some experts are unable to explain the rationale for the student loan “no bankruptcy” exception. While others agree that it grew from a concern that student loan borrowers could take advantage of bankruptcy laws. For example, the law prohibits students from borrowing debt, earn a degree and then file for bankruptcy.

There are, however, exceptions such as the difficult to qualify for Brunner Test.

The Brunner Test

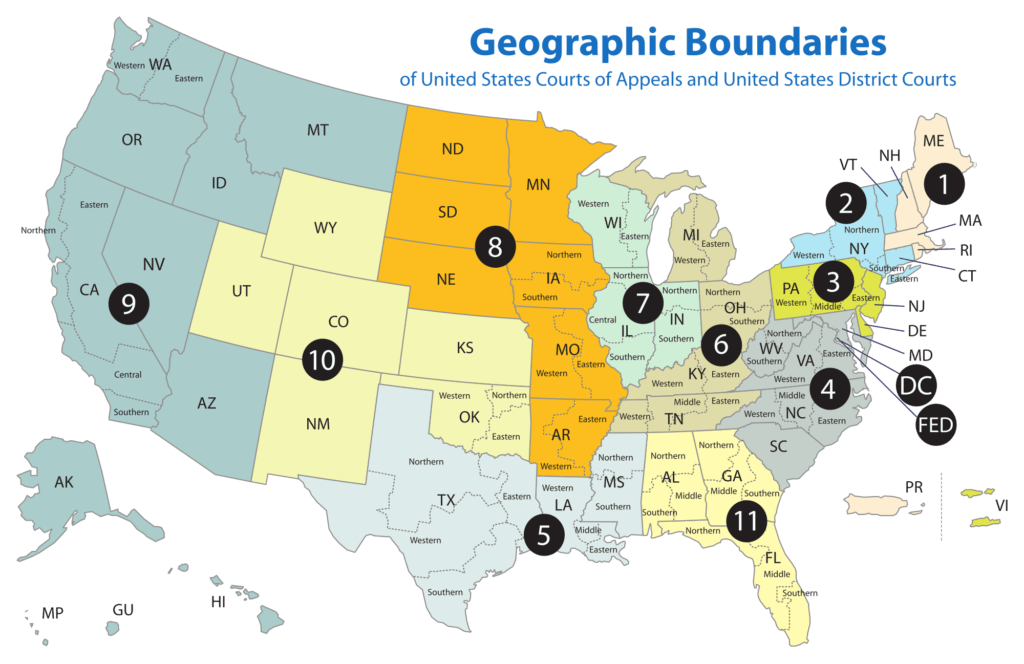

The Brunner test is the legal test in all circuit courts except the 8th and 1st circuits. The 8th circuit court uses a totality of circumstances, which is similar to Brunner. On the other hand, the 1st circuit has yet to declare a standard.

To qualify for financial hardship under the Brunner test, you must meet three conditions:

- The borrower and dependents would be unable to maintain a minimal standard of living.

- Financial difficulties are expected to last through the term of the loan.

- The borrower made efforts to keep up with your payments before filing bankruptcy.

While there are several variances across federal districts, this is just the basic framework.

Discharging Student Debt in Bankruptcy

In order to qualify for a student loan discharged through bankruptcy, an adversary proceeding (a lawsuit within bankruptcy court) must be filed. During this process, a debtor claims that pay the student loan would create an undue hardship for the debtor.

Was There Ever a Time I Could Discharge My Student Debt

Before 1976, you could discharge your student loans in bankruptcy. Congress, however, changed the law. Requiring student loans have been in repayment for five years. A few years later, that period was extended to seven years.

In 1998, Congress removed the option unless a debtor could show that paying the student loan would create an undue hardship. Further, in 2005, Congress extended this protection to include private student loans.

The Carlson Law Firm Can Help

Making the decision to file for bankruptcy can be tough. However, it is not the black mark many people think it is. Instead, it is a way for you to get your life back without having to worry about harassing phone calls. The Carlson Law Firm can help you start over. If you are in the Waco or Killeen-Temple area, contact our firm to speak with leading Bankruptcy Attorney Vicki Carlson.