Student loan debt is now the second highest consumer debt category—second only behind mortgage debt. Because of Congress’ past actions, it is difficult to get a court to dismiss your student debt. Fortunately, that doesn’t mean wiping out your student loan debt through bankruptcy is impossible.

In a previous piece on bankruptcy, we discussed how difficult it is to get your student loans dismissed in a bankruptcy. In fact, for most people bankruptcy generally cannot relieve you of your student loan debt. The only way to get your student loans completely dismissed by filing for bankruptcy is to prove “undue hardship.” Proving undue hardship is actually becoming easier as courts begin to recognize the burden massive debts are placing on students. Over the last few years, courts have been slowly evolving on what undue hardship actually means for the new generation of student debt holders. Millennials carry the most student loan debt of any generation because of climbing tuition.

What do courts consider undue hardship?

Filing Chapter 7 or chapter 13 bankruptcy won’t wipe out your student loan debt unless you can prove undue hardship. To demonstrate undue hardship, you must prove that making payments on your student loans will prevent you or your dependents from getting your basic necessities. Because the bankruptcy code doesn’t define undue hardship, courts use different tests to evaluate whether a particular borrower has shown undue hardship.

The Brunner Test

The most common test courts use is the Brunner test. Many courts adopted the Brunner Test in 1987. The test came after Marie Brunner filed for a discharge of her student loans less than a year after she completed her Master’s Degree. The Brunner test requires that a borrower show all three of these factors:

- Poverty. The debtor cannot maintain a “minimal” standard of living for the debtor and the debtor’s dependants if forced to repay the student loans on current income.

- On going financial problems. There are additional circumstances that exist that indicates that this state of affairs is likely to persist for most of the repayment period of the student loans.

- Good faith. The debtor has made good faith efforts to repay the loans.

The totality of Circumstances Test

Not all courts have adopted the Brunner Test. Some courts use the totality of circumstances. In these instances, courts take into consideration all relevant factors in your case to determine if student loan repayment is an undue hardship.

There are several other tests that courts use. To find out what tests your local bankruptcy court uses, speak to a qualified Bankruptcy attorney in your area.

If you manage to prove undue hardship and successfully declare bankruptcy on your student loans, your loans will be either partially or fully discharged or restructured. If your student loan payments are restructured, you will receive a new repayment plan that should be easier for you to handle.

What is the Bankruptcy Procedure to Discharge My Student Loans?

Requesting a student loan discharge comes at the end of the bankruptcy process. A qualified bankruptcy attorney can explain what the bankruptcy process involves. However, if you know that filing bankruptcy is a possibility, there are some steps you can take to prepare for student loan debt discharge.

- Go on an income-based repayment plan. If you are having a difficult time making payments on your student loans, don’t just stop paying. There are several plans available that can alleviate some of the burdens of making full payments each month. Before pursuing bankruptcy as a means for student loan dismissal, you need to establish that you have made every effort to repay the debt. If you are having a difficult time making, call your lender to discuss your options.

- Find a qualified bankruptcy attorney. A bankruptcy attorney works in certain bankruptcy courts and knows how likely a judge is to discharge your student loans.

- File for Chapter 7 or Chapter 13 bankruptcy. Your bankruptcy can help you determine what type of consumer bankruptcy is best for you. If you’ve already filed for bankruptcy but didn’t attempt to have your student loan debt relief, you can reopen the case and ask the court to discharge them.

How do I Prove Student Loan Payments are an Undue Hardship?

It should be noted, that courts do not have consistent markers for what exactly meets undue hardship. What one court may consider undue hardship, another may not. For example, a 50-year-old student loan borrower who has consistently made $8.50 an hour as a telemarketer may get granted a discharge, while a 30-year-old in the same situation may not. The court may rule that at 50, a person is likely stuck in a “cycle of poverty”, but a 30-year-old has yet to show a history of low wages.

Because of the changing landscape of wages compared to student loans some judges have redefined what undue hardship means. In 1987 when the Brunner test was first developed, student loan borrowers did not face nearly as much debt as today’s millennials do. In 2014, a court found that borrowers do not have to be at poverty level income to prove undue hardship. The court described a minimal standard of living as somewhere between “poverty” and “mere difficult.”

Adversary Proceedings

Very few people try erasing student debt in bankruptcy. In fact, in 2007, only an estimated .1 percent of people who filed bankruptcy even attempted to erase the debt. According to a 2012 study, of the 207 bankruptcy cases examined, 39 percent got a full or partial student loan discharge.

In a typical bankruptcy proceeding, a debtor is hoping to discharge debts and the creditor wants to get paid. There is usually no dispute between the creditor and the debtor. In most cases, an applicant who meets the bankruptcy requirement will receive the benefit they’ve requested. However, when there is a dispute, a bankruptcy court will handle the case after the debtor files a lawsuit. This is called an adversary proceeding. In order to get student loans discharged, you will have to file an adversary proceeding in order to determine the discharge-ability with the bankruptcy court.

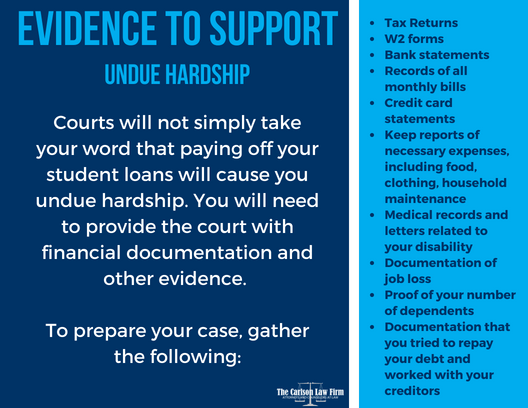

During the adversary proceeding, you will need to present evidence to prove to the court that your loans will cause you an undue hardship. In some courts, you will need an expert to testify on your behalf about your ability for gainful employment.

If I don’t have an undue hardship, how can I get student loan debt relief?

If you know that you don’t qualify for student loan relief through bankruptcy, there are several federal programs available to you. Borrowers can have their federal student loans forgiven through the following ways:

Become a teacher in a low-income area public school

The Teacher Forgiveness program will forgive up to $17,500 on your Direct Subsidized and Unsubsidized loans, as well as your Subsidized and Unsubsidized Federal Stafford Loans. To qualify for the program, you must:

- Not have an outstanding balance on Direct Loan or Federal Family Education Loan Programs loans as of Oct. 1, 1998; or on the date that you obtained a Direct Loan or FFEL program loan.

- Employed as a full-time, highly qualified teacher for five complete and consecutive academic years. One of those years must have been after 1997-1998 academic year.

- Employed at a public school that serves low-income students.

- The loans must have been made before the end of your five academic years of qualifying teaching service.

Join the military

Each branch of the U.S. military offers some form of student loan forgiveness. In fact, millions of people serve every year to earn GI Bill benefits for themselves or their families. Forgiven loan amounts depend on the level of rank achieved.

Apply for an Income-Based Repayment Plan

Everyone should consider applying for the income-based repayment plan. The program sets your monthly loan payments at no more than 15 percent of their discretionary income.

Get a public service, government or non-profit job

Those who borrowed money under the William D. Ford Federal Direct Loan program can apply to the Public Service Loan Forgiveness Program. In this program, full-time employees in the public service or non-profit sector can have the remainder of their outstanding debt forgiven after they successfully make 120 qualified loan payments.

According to the U.S. Office of Education’s federal student aid website, jobs that qualify as public service include:

- Employment with federal, state or local government agency, entity or organization; and

- A non-profit organization that the Internal Revenue Service (IRS) deemed tax-exempt under Section 501(c)(3) of the Internal Revenue Code (IRC).

Guidance from a Texas Bankruptcy Attorney

Student loan debt will follow you for the rest of your life. However, if you are drowning in debt, there is help. If you believe that you are dealing with an undue hardship and are unable to pay your student loans and other bills, contact us to schedule a free consultation with our award-winning Bankruptcy Attorney. We can help guide you through the bankruptcy process, explaining every action along the way.

Contact us to schedule a free case evaluation today.

Find a bankruptcy attorney near me.