Tip pooling is one of the most controversial issues for both diners and restaurant workers. Serving customers in a restaurant is not an easy job. It is one of the only professions where making a livable wage is entirely dependent on a customer’s etiquette and generosity. At the end of each meal, diners are tasked with remembering everything they learned in pre-algebra to figure out a “good” percentage tip for their server. The general rule is that customers tip 15-20 percent of the bill. However, in many cases, diners base their tip on the quality of service they receive.

This is why both diners and wait staff have strong opinions about the idea of tip pooling. Tip pooling means that servers surrender their tips to a general pool. From the pool, tips are then divided among the entire wait staff and, sometimes the minimum wage earning back-of-house staff, such as cooks, bus staff, and dishwashers.

In March 2018, President Donald Trump signed an omnibus bill into law that contained several provisions relating to tip pooling.

What You Need to Know About Restaurant Tips

The Fair Labor Standards Act (FLSA) contains a tip credit provision that allows employers to pay a reduced hourly wage to tipped employees. Under federal law, American restaurants are legally allowed to pay servers $2.13 an hour, instead of the federal minimum wage of $7.25 an hour. However, the rule requires that employees receive enough in tips to bring their hourly rate to local, state or federal minimum wage—whichever is the prevailing practice.

In 2011, the U.S. Department of Labor (DOL) amended the FLSA to make it clear that tip-pooling requirements applied to all employees receiving tips. The regulation prevented tip pooling between tipped and non-tipped employees regardless of the wage rate paid. The regulation specified: “Tips are are the property of the employee whether or not the employer has taken a tip credit…”

The Bill that Almost Was

Typically, managers, owners, CEOs and food service directors are not included in the tip pool. However, in December 2017, the Department of Labor proposed rescinding the 2011 regulation that made it clear that all tip money earned was the employee’s property, not the employer’s. The DOL’s announcement asserted that without tip pooling, there were significant pay disparities between servers and back of house staff.

In its initial proposal, the DOL intended to allow employers to redistribute servers’ tips however they wanted, as long as all employees were paid at least the federal minimum wage of $7.25 an hour. In other words, the employer could do anything with tip money; from redistributing among customer-facing employees and back of house employees to including management staff in the tip pooling or simply keep the tips for their business.

This proposed rule was met with sharp criticism from workers’ rights groups, customers, and servers. The opposition came because the bill did not expressly prohibit employers from sharing in tip pools. Without making this clear, managers, supervisors or business owners could legally keep tips, totaling in the billions, for themselves.

What Tipping Changes did The Trump Administration Sign into Law?

On March 27, 2018, Trump signed Congress’ $1.3 trillion omnibus budget bill into law. Under this bill, Congress amended the FLSA and addressed tipped employees and tip ownership. The bill departed from the DOL’s initial proposal which would have allowed businesses to pocket the tips earned by its servers. Instead, Trump signed a “compromise” into law that retained the Obama-era regulation. The bill upholds the language that makes it clear that employers cannot, under any circumstances, keep any portion of the tips earned by their workers. However, the law does allow tip redistribution between non-tipped workers only if employers pay all of their employers the regular minimum wage in their jurisdictions. Also, under the new law, the tip pool excludes supervisors, managers, and owners.

The rule also applies to tipped employees in other fields like hairstylists and manicurists.

In regards to tipping, the FLSA amendment does the following:

- Unequivocally states that employers may not retain employee tips, regardless of whether a tip credit is taken

- Prohibits managers, supervisors and business owners from retaining servers’ tips

- Penalizes an employer with a civil penalty of up to $1,100 for each instance of wage theft

- Allows employees to file civil lawsuits in instances of wage theft

- Allows tip sharing with non-tipped employees only if all employees make minimum wage and the business does not take the tip credit

- Forbids the distribution of tips between non-tipped employees when the business takes a tip credit

Why is the New Tip Pooling Law Controversial?

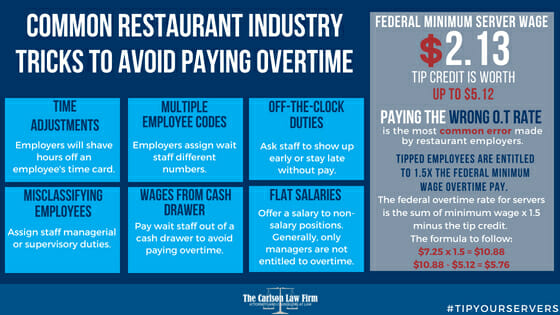

In general, the topic of tip pooling is controversial because wage theft is already rampant in the restaurant industry. Workers lose billions of dollars annually because of wage theft. The act redistributes the tip amount a customer has intended for their server. Many people are aware that servers make $2.13 an hour and realize that many of these employees depend on tips to make a living wage.

On a policy level, the 2018 FLSA changes were controversial because the Labor Department ditched unfavorable data from its tip proposal showing the amount that employers could skim from wait staff tips. The internal analysis showed that employees could lose out on billions of dollars in gratuities. To lessen the impact, senior department political officials ordered staff to revise the data methodology. Even with the change in methodology, numbers were still unfavorable to the department’s goal to roll back the Obama-era regulation. Labor Secretary Alexander Acosta and his team received approval from the White House to publish a Dec. 5, 2017 proposal that removed the economic transfer data altogether.

By removing this data, the labor department was presenting incomplete information to the public. This means that interested parties such as restaurant workers and advocacy groups would have to weigh in on a topic without first seeing the government’s estimate on the economic impact it would have.

How Do I Know if I am a Victim of Wage Theft?

As an employee, federal law entitles you to certain rights. Even under tipping rules in the amended FLSA, employees own their tips. Because restaurant workers are especially vulnerable to an employer’s illegal acts, this information is especially important to tipped employees in the restaurant industry.

Your employer is stealing from you if:

- Management participates in tip pools, i.e. takes a cut of the tips

- Employer forces you to pay for a table that eats and doesn’t pay

- Tips are deducted based on your pay

- You are paid less than the minimum wage

- Your employer fails to or refuses to pay you overtime

- Altering time cards to inaccurately reflect hours worked

- Your employer is not paying you at all

- You do not receive your final paycheck after leaving a job

If your employer has stolen tips from you, contact The Carlson Law Firm

The Carlson Law Firm is here to fight for you. We will fight tirelessly on your behalf to prove your employer or former employer stole money from you. If you believe that your employer has improperly taken a portion of your tips or you are receiving less than the minimum hourly wage, it is in your best interest to speak with a qualified Wage Theft Attorney. Our firm is ready to help you navigate the legal system. We will help you get the compensation the law entitles you to.

If you have questions about your employment situation, contact The Carlson Law Firm. We can answer your questions about tip pooling and wage theft.